Introduction

Growing global awareness of climate change, social injustices, and governance issues has made it imperative for companies to report not only their financial performance but also their environmental and social impacts. Sustainability reporting, born out of this need, is now carried out through various standards and frameworks. Among these, the Global Reporting Initiative (GRI) Standards are the most widely accepted globally, while in Turkey, the Turkey Sustainability Reporting Standards (TSRS) stand out. This article aims to examine the similarities and differences between these two important frameworks.

1. Overview of GRI Standards and TSRS

GRI (Global Reporting Initiative) Standards: These are the most widely used sustainability reporting framework worldwide. Developed through a multi-stakeholder approach, they enable organizations to comprehensively report their economic, environmental, and social impacts. The framework is flexible and encourages a focus on “priority topics.”

TSRS (Turkey Sustainability Reporting Standards): These are a set of standards published by the Capital Markets Board of Turkey (SPK) and are legally mandatory for specific companies. They are based on the internationally accepted IFRS S1 and IFRS S2 standards. TSRS primarily focuses on understanding the impact of climate-related and sustainability-related risks and opportunities on a company’s financial position.

2. Key Similarities Between GRI and TSRS

- Integrated Reporting Approach: Both standards embrace the principle that companies should disclose not only financial information but also their non-financial performance to stakeholders.

- Importance of Stakeholder Engagement: GRI adopts an approach centered on stakeholder involvement and interaction. TSRS also expects companies to identify stakeholders in their value chain and understand their relationships with them.

- Common Environmental Themes: Environmental issues such as climate change, biodiversity, water resources, and waste management are significant in both frameworks.

- Emphasis on Governance: How company management addresses sustainability issues, assesses risks, and distributes responsibilities within the management structure are key reporting topics in both standards.

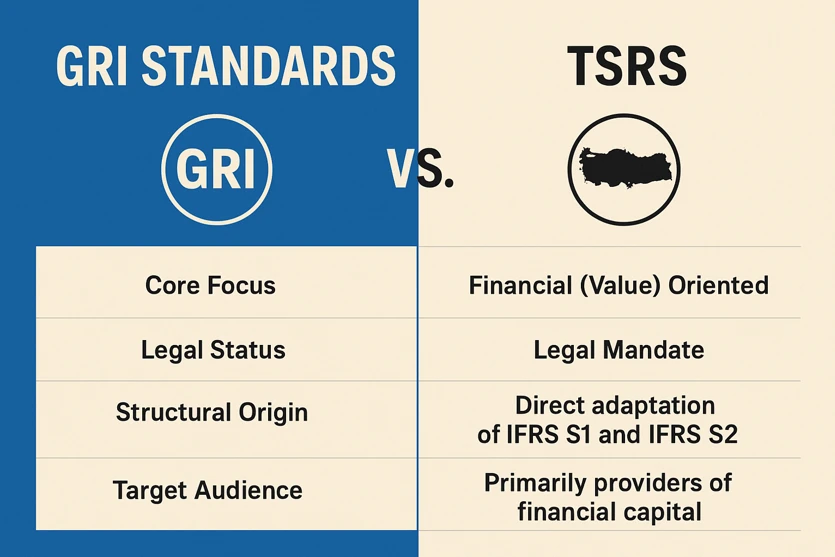

3. Key Differences Between GRI and TSRS

| Feature | GRI Standards | TSRS |

| Core Focus | Impact-Oriented – Accountability for the organization’s positive and negative impacts on the external world (environment, society). | Financial (Value) Oriented – Assessing the potential impact of sustainability-related risks and opportunities on the organization’s financial position, financial performance, and business model. |

| Legal Status | Voluntary (Though mandated in some countries and stock exchanges, it is generally a voluntary framework). | Legal Mandate – A binding standard for companies specified by the SPK (e.g., large public companies, banks). |

| Structural Origin | Independently developed by GRI through a multi-stakeholder process. | Direct adaptation of IFRS S1 and IFRS S2 standards issued by the International Financial Reporting Standards (IFRS) Foundation. |

| Content & Scope | Broader and more detailed coverage. Includes in-depth disclosures on social topics like human rights, working conditions, and community contributions. | More focused content. Primarily structured around governance, strategy, risk management, metrics, and targets. Climate (IFRS S2) is central. |

| Target Audience | Wide range of stakeholders (investors, employees, customers, civil society, local communities, etc.). | Primarily providers of financial capital (investors, banks, creditors). |

| Prioritization | Determined through materiality analysis of the organization’s most significant impacts (“priority topics”). These impacts can be internal or external. | Based on the measurable impact of sustainability-related risks and opportunities on financial statements. This is referred to as financial materiality. |

4. Reading Them as Complementary Frameworks

GRI and TSRS are not competing standards but complementary frameworks serving different purposes.

- A company uses TSRS to answer investors’ question: “How do climate crises and other sustainability issues affect my company’s value and financial future?”

- The same company uses GRI to answer all stakeholders’ question: “What is our company’s impact on society and the environment? How do we contribute to or take responsibility for human rights, employee well-being, and environmental sustainability?”

Therefore, companies aiming for a comprehensive and transparent sustainability strategy can use both frameworks in parallel. Combining TSRS’s financially oriented structure with GRI’s impact-oriented comprehensive approach can provide a holistic view of the company’s internal and external context.

Conclusion

Sustainability reporting has evolved from a “goodwill indicator” to a global necessity. For companies in Turkey, TSRS is critical for legal compliance and demonstrating financial risks to investors. However, the GRI Standards remain the most comprehensive and reliable framework for understanding an organization’s actual impact on society and the environment. In the future, the integrated use of these two sets of standards will be key to effectively reporting sustainable business models.